Elevate Your Banking Experience With Cooperative Credit Union

Discovering the world of banking experiences can commonly lead to discovering surprise gems that offer a refreshing separation from conventional banks. Cooperative credit union, with their focus on member-centric services and area involvement, present an engaging alternative to conventional banking. By prioritizing private requirements and fostering a feeling of belonging within their subscription base, cooperative credit union have actually carved out a particular niche that resonates with those looking for a more tailored strategy to managing their financial resources. But what sets them apart in terms of raising the financial experience? Let's dig deeper right into the one-of-a-kind benefits that cooperative credit union give the table.

Advantages of Cooperative Credit Union

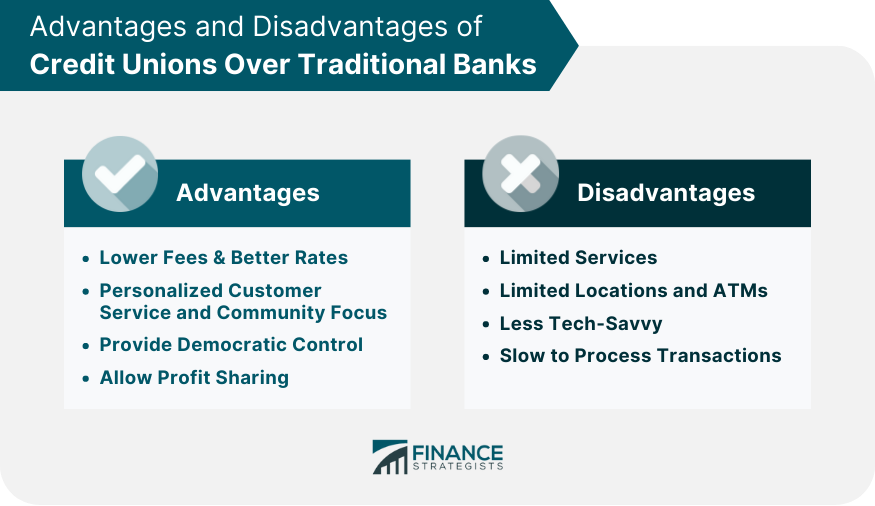

Using a series of monetary services customized to the requirements of their participants, cooperative credit union give numerous benefits that establish them besides traditional banks. One key benefit of credit report unions is their concentrate on area participation and member satisfaction. Unlike banks, cooperative credit union are not-for-profit companies possessed by their members, which typically results in decrease charges and far better rate of interest on interest-bearing accounts, lendings, and charge card. In addition, lending institution are known for their customized customer care, with personnel making the effort to recognize the distinct monetary goals and challenges of each member.

An additional advantage of credit report unions is their autonomous framework, where each member has an equivalent ballot in choosing the board of directors. Credit rating unions commonly provide financial education and learning and therapy to aid participants improve their monetary proficiency and make educated decisions regarding their money.

Membership Requirements

Some credit history unions may offer individuals who function or live in a specific geographical location, while others may be affiliated with particular companies, unions, or organizations. Additionally, family participants of current credit history union members are often eligible to join as well.

To become a participant of a lending institution, individuals are generally called for to open an account and maintain a minimum deposit as specified by the institution. In many cases, there might be one-time subscription costs or recurring subscription charges. When the subscription standards are met, people can delight in the advantages of belonging to a credit scores union, including accessibility to customized economic services, affordable interest rates, and a focus on member contentment.

Personalized Financial Solutions

Personalized monetary services tailored to individual needs and preferences are a characteristic of cooperative credit union' commitment to member satisfaction. Unlike typical banks that frequently provide one-size-fits-all remedies, cooperative credit union take a more customized method to managing their participants' finances. By recognizing the one-of-a-kind objectives and situations of each participant, cooperative credit union can provide tailored referrals on cost savings, investments, loans, and various other monetary items.

Debt unions prioritize constructing solid relationships with their participants, which permits them to use individualized services that exceed just the numbers. Whether a person is saving for a details goal, preparing for retirement, or looking to boost their credit rating, lending institution can produce personalized financial strategies to help participants achieve their purposes.

Moreover, cooperative credit union normally use lower costs and competitive rate of interest prices on savings and lendings accounts, even more boosting the personalized economic solutions they supply. Cheyenne Federal Credit Union. By focusing on individual requirements and supplying tailored solutions, credit score unions set themselves apart as relied on financial partners committed to assisting members grow monetarily

Neighborhood Participation and Support

Community engagement is a foundation of lending institution' objective, showing their dedication to sustaining regional campaigns and fostering purposeful links. Lending institution proactively take part in neighborhood events, sponsor regional charities, and arrange economic proficiency programs to enlighten members and non-members alike. By buying the communities they serve, credit score unions not only strengthen their connections however also add to the total health of society.

Supporting small services is another way lending institution demonstrate their commitment to neighborhood neighborhoods. With offering bank loan and financial guidance, lending institution aid business owners prosper and stimulate financial development in the area. This assistance surpasses just economic assistance; lending institution commonly provide mentorship and networking chances to assist small companies do well.

Furthermore, debt unions regularly participate in volunteer work, motivating their participants and workers to give back with different community solution tasks. Whether it's joining local clean-up events or organizing food drives, lending institution play an energetic function in enhancing the quality of life for those in requirement. By prioritizing community involvement and support, cooperative credit union absolutely embody the spirit of participation and common assistance.

Online Financial and Mobile Applications

Mobile apps supplied by cooperative credit union further enhance the financial experience by providing extra flexibility and ease of access. Participants can carry out various banking tasks on the go, such as depositing checks by taking an image, obtaining account alerts, and even contacting client support directly with the app. The safety of these mobile applications is a top priority, with attributes like biometric verification and encryption methods to safeguard sensitive details. In general, cooperative credit union' online banking and mobile applications empower members to manage their financial resources successfully and securely in today's fast-paced electronic world.

Conclusion

In final thought, credit rating unions use a special banking experience that focuses on community involvement, customized solution, and participant fulfillment. With reduced fees, competitive passion prices, and customized financial services, credit report unions cater to specific needs and advertise financial well-being.

Unlike financial institutions, credit rating unions are not-for-profit companies possessed by their members, which typically leads to decrease costs and far better interest prices on financial savings accounts, car loans, and credit report cards. In addition, credit report unions are known for their customized customer service, with team participants taking the time to comprehend the unique financial objectives and difficulties of each member.